THE NEXT BIG CRITICAL MINERAL DISCOVERY

Microsoft Just Placed a Big Bet on Nuclear

The world’s second largest A.I. company sees it as the best way to satisfy their skyrocketing energy demands.

What it means for domestic supply chains, and for Stallion Uranium Corp. (TSX-V:STUD; OTC:STLNF), the explorer unlocking one of North America’s hotspots.

Microsoft has a problem.

With the growth of the $2 trillion+ company’s AI division, and its ever-growing data centers, Microsoft consumes an enormous amount of energy. It is more commonly ranked next to small countries than large companies.

And, with ever-growing amounts of data and an AI sector just starting to take off, energy needs going forward look to be even greater than anyone predicted.

In fact, the problem of providing enough energy is so dire, Microsoft has performed experiments hosting data centers underwater, trying to take advantage of the cold temperature for energy savings.

It worked. But it’s still an open question whether the entire operation makes economic sense.

That’s why the company opened up a surprising role this last year – seeking a program manager to guide the company’s advanced nuclear reactor strategy.[i]

The company plans to run its data centers and future AI efforts, at least partially, on the back of nuclear power.

It makes perfect sense.

Nuclear power is incredibly efficient. Indeed, by most measures, it is the most efficient energy source we have.

That’s why Microsoft is not alone at looking to nuclear to help solve the world’s energy crunch.

There’s just one problem:

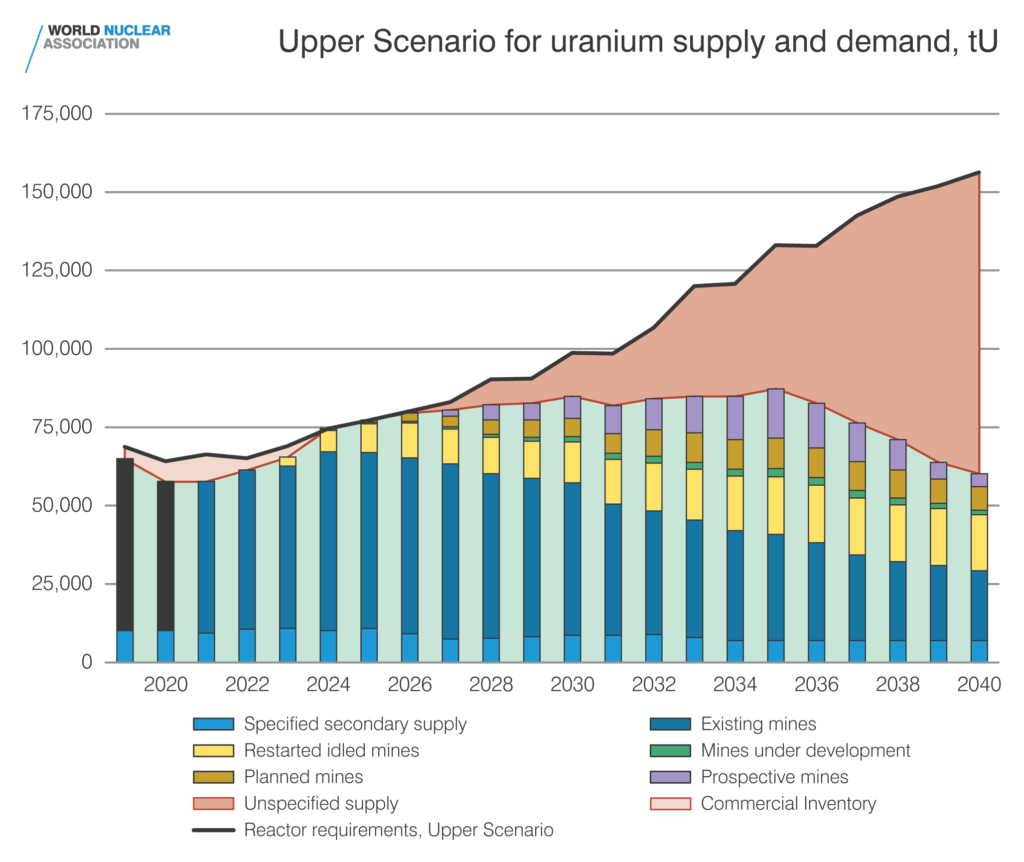

There are more plans for new uses of nuclear than there is uranium to fuel the plants!

This is especially so if you look at domestic production. The US uses about 28% of worldwide uranium production, but produces less than 1%.

This is a solvable issue.

And the companies that solve it stand to benefit tremendously.

[i] https://www.theverge.com/2023/9/26/23889956/microsoft-next-generation-nuclear-energy-smr-job-hiring

“Clean Nuclear Energy The Powerhouse of the Future, Endorsed by Titans Buffett and Gates”

Warren Buffett and Bill Gates have shown their belief in the future of nuclear energy through significant investments. They have been involved in projects that aim to develop nuclear power plants utilizing advanced technologies. For instance, Gates has been a long-time advocate for nuclear energy as a solution to climate change, citing its ability to provide constant, carbon-free energy. His company, TerraPower, which he founded in 2006, has been working on developing next-generation nuclear reactors that are safer and more efficient.

Buffett, through Berkshire Hathaway, has also been involved in the energy sector and has shown interest in sustainable and reliable energy sources, including nuclear power. The collaboration between such high-profile investors in nuclear technology development projects highlights the growing confidence in nuclear energy as a sustainable and reliable power source for the future.

Their investments align with a broader recognition of the role nuclear power can play in a clean energy transition. With its ability to provide high-density energy without greenhouse gas emissions, nuclear energy is being re-evaluated globally as a critical component of energy strategies aiming for carbon neutrality.

The engagement of Warren Buffett and Bill Gates in nuclear energy projects reflects a significant endorsement of nuclear power as a key element in the energy matrix of the future, underscoring its potential to contribute to tackling climate change and meeting the world’s increasing energy demands sustainably.

Symbol: (TSX-V: STUD) (OTCQB: STLNF) (FSE: HM40)

Company: Stallion Uranium Corp. (TSX-V: STUD)

Quote: https://finance.yahoo.com/quote/STUD.V

Latest News: https://finance.yahoo.com/quote/STUD.V/news?p=STUD.V

Company Website: https://stallionuranium.com/

The remarkable surge in uranium prices, coupled with a global shift towards nuclear energy, presents a significant opportunity for uranium mining companies. As countries increasingly embrace nuclear energy as part of their clean energy mix, the demand for uranium, the primary fuel for nuclear reactors, is rising. This growing demand directly benefits uranium mining companies as they are the primary suppliers of this critical commodity. The sharp increase in uranium prices, reaching heights not seen since 2008, means these companies can sell their uranium at much higher rates, boosting their profitability.

The remarkable surge in uranium prices, coupled with a global shift towards nuclear energy, presents a significant opportunity for uranium mining companies. As countries increasingly embrace nuclear energy as part of their clean energy mix, the demand for uranium, the primary fuel for nuclear reactors, is rising. This growing demand directly benefits uranium mining companies as they are the primary suppliers of this critical commodity. The sharp increase in uranium prices, reaching heights not seen since 2008, means these companies can sell their uranium at much higher rates, boosting their profitability.

Investor Interest and Strategic Investments: The heightened investor interest in uranium stocks also plays a crucial role. The surge in shares of companies like Cameco Corp., and the performance of funds like the Sprott Uranium Miners Exchange-Traded Fund, reflect this investor enthusiasm, bringing in more capital and driving up the stock prices of uranium mining companies. Moreover, with the global market looking to diversify uranium supply sources away from dominant suppliers like Russia and China, new investment is likely to flow into uranium mining projects in politically stable regions, benefiting companies in these areas.

Expansion and Long-Term Growth Prospects: These favorable market conditions provide an incentive for uranium mining companies to expand their operations, including opening new mines, increasing production in existing mines, or investing in advanced mining technologies to enhance efficiency and output. The stable and growing demand for uranium might also encourage long-term contracts with mining companies, providing a steady and predictable revenue stream.

Global Expansion and Market Dynamics: Additionally, the global expansion of nuclear energy, particularly in countries like China and the extended lifespan of existing nuclear facilities worldwide, ensures a sustained demand for uranium. Mining companies well-positioned to meet this demand can expect long-term growth. While some hedge fund managers are considering short-selling strategies for stocks they deem overvalued, the overall market speculation and the influx of investment into the sector can benefit mining companies, especially those with robust fundamentals and promising growth prospects. However, it’s crucial to remember that while there are significant opportunities, there are also risks involved, including regulatory challenges, environmental concerns, and market volatility that uranium mining companies must navigate.

Uranium's Moment is Now with Rising Demand and Waning Supply

Uranium Mining in the RICH Athabasca Basin and A Small Cap Company with LARGE POTENTIAL!

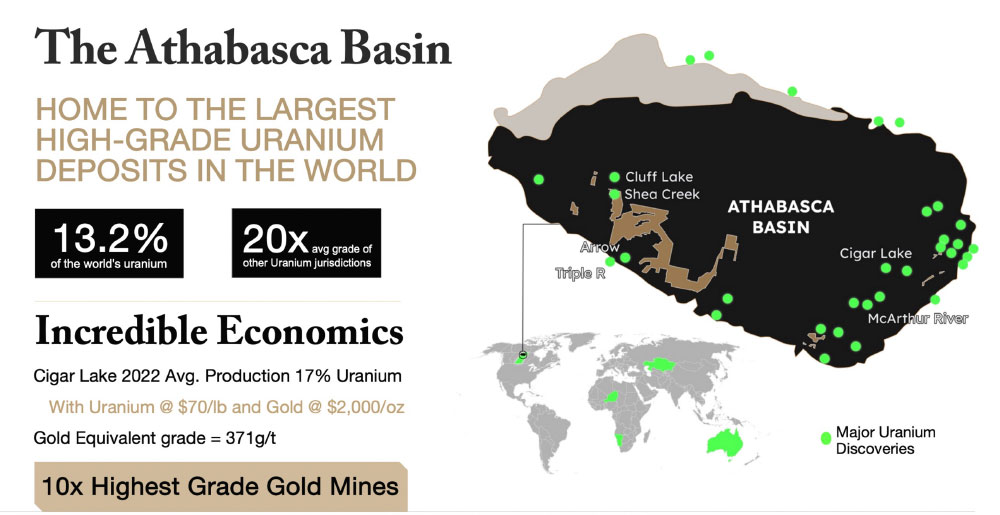

- Canada is the U.S.’s second-largest trading partner (narrowly eclipsed by Mexico). Canada produced 7,351 tonnes of uranium in 2022, accounting for 15% of the world's total production, ranking it second behind only Kazakhstan.

- For decades, Canada was the world’s biggest uranium producer until Kazakhstan surpassed it in 2009. Production comes mainly from Cameco’s (TSX: CCO)(NYSE: CCJ) McArthur River and Cigar Lake mines in northern Saskatchewan province, home to the Athabasca Basin and the largest and highest-grade uranium in the world.

- Over 900 million pounds of U3O8 (triuranium octoxide, one of the more popular forms of uranium yellowcake) have been produced since 1975 from the basin. While still vastly underexplored, the region is host to the third-largest known uranium resources (606,600 tonnes of U3O8) on Earth.

Join our exclusive group of traders and if we don’t deliver, simply unsubscribe anytime!

That Brings Us To Stallion Uranium Corp.

Symbol: (TSX-V: STUD) (OTCQB: STLNF) (FSE: FEO)

Company: Stallion Uranium Corp. (TSX-V: STUD)

Quote: https://finance.yahoo.com/quote/STUD.V

Latest News: https://finance.yahoo.com/quote/STUD.V/news?p=STUD.V

Company Website: https://stallionuranium.com/

Stallion Uranium Corp. is working to fuel the future through the exploration of over 3,000 sq/km in the Athabasca Basin, home to the largest high-grade uranium deposits in the world. The company holds the largest contiguous project in the Western Athabasca Basin adjacent to multiple high-grade discovery zones, including Uranium Energy Corp.’s Shea Creek deposit, which is projected to hold 95 million lbs. of uranium and Orano’s Cluff Lake, which produced 62 million lbs. of uranium over its lifetime.

In the past year, Stallion has expanded its stake, making it by far the largest uranium explorer in the Southwestern Athabasca Basin.

Additional strategic land staking have added over 30,000 hectares this year to Stallion’s holdings, making the full property over 330,000 hectares.

And with exploration well underway on multiple projects, the company is working quickly to prove out their potential resources.

Initial results are already suggestive of the potential for a large discovery.

Stallion Uranium Identifies Massive 94.7 Meter Conductive Structure

The company’s 100% owned Coffer project sits just 13km east of Shea Creek, and shares many geological similarities. It’s here at the northernmost corner, the Apaloosa target, that Stallion just concluded a maiden diamond drilling program spanning approximately 2,800 meters.

Three diamond drill holes were completed, with every single one encountering anomalous radioactivity.

The final drill hole culminated with the discovery of a large, deep-rooted conductive structure spanning 94.7 meters in length.

It is a target that has all of the characteristics necessary to host a large uranium deposit.

Stallion CEO, Drew Zimmerman made that point very clear.

“Stallion’s maiden drill program was big step towards a discovery hole for the company. We now know the location of the targeted structure, we know the structure is fertile from anomalous radioactivity in all 3 drill holes, we know the structure is large enough to host a significant deposit, and we know where to target next.”

Those next steps will most certainly be made known to the public soon.

Diversified Holdings Across The Athabasca Basin

The company has also been making substantial headway on the 100%-owned Sandy Lake project.

This 3,791 hectare project shares many similar geophysical characteristics to both Shea Creek deposit and Cluff Lake deposit (sitting 13km to the east).

Stallion Uranium just completed an airborne geophysical survey, in which they outlined 27 kms of conductive trends for further review and exploration – including five specific targets which will be the focus of the second phase of exploration.

Next steps will entail ground geophysics to further define these targets in advance of drilling.

Significant Potential at Horse Heaven Property, Idaho

The company’s Horse Heaven Property in Idaho, where historical antimony mining activities took place, is showing significant potential.

Notably, Antimony Ridge, located on this property, has been identified for its critical and strategic mineral reserves. The US Geological Survey includes antimony in its list of critical minerals, and the location’s proximity to major US government investments in adjacent properties signals its strategic importance. CEO Drew Zimmerman expressed optimism about the initial sampling results, indicating substantial gold and antimony mineralization, which suggests a high potential for the property to become a major antimony system.

The initial rock sampling conducted by Stallion Uranium in 2022 revealed widespread antimony-gold-silver mineralization across significant widths on the Horse Heaven Property. The assay results from this exploration work are encouraging, with a majority of the samples showing notable concentrations of these minerals. Specifically, discrete vein exposures showed high levels of gold, silver, and antimony, highlighting the property’s potential for yielding valuable resources.

A Team with a Vision and Track Record of Significant Success in the Basin

The team behind Stallion Uranium Corp. has a proven track record in the uranium mining industry, which is a compelling factor for potential investors. Key members were involved in Hathor Exploration, sold to Rio Tinto for $650 million in 2012, with Stephen Stanley (now on Stallion’s Board of Advisors) as its CEO. They also played significant roles in NexGen Energy, currently valued at $4 billion, and ATHA Energy, with a market cap of $150 million. Their expertise and successful history in identifying and developing major deposits in the Athabasca Basin reinforce Stallion’s potential in the uranium mining sector.

Stallion Uranium Corp. is an emerging player with compelling investment highlights in the uranium mining industry:

- Stallion Uranium Corp.'s venture into the Western Athabasca Basin with their MobileMT™ survey is a pioneering move in the uranium sector.

- This high-tech survey is a significant leap in exploration, marking the first-ever effective survey of most of the 2,200 km² JV Project area. The MobileMT technology, an advanced form of airborne Audio Frequency Magnetic (AFMAG) technology, can detect deep subsurface electromagnetic conductors and resistivity zones linked to uranium deposits.

- Covering 12,730 line-kilometers, this survey is a strategic step towards uncovering new uranium-rich zones, potentially marking Stallion as a key player in uranium exploration.

- The project's success could be a game-changer, offering investors and traders an exciting opportunity in the uranium market.

"Stallion Uranium Corp A Bright Spot for Traders with Strong Buy Indicators"

Stallion Uranium Corp. has garnered a positive outlook from certain short-term and medium-term indicators on Barchart. With a “Buy” rating from the Trend Seeker and positive signals from short-term indicators such as the 20 Day Moving Average and the 20 – 100 Day MACD Oscillator, these suggest an upward trend that could be seen as an opportunity for traders looking for potential growth. Furthermore, the 100-Day Moving Average, a long-term indicator, also stands on a “Buy” signal, offering an additional perspective of potential long-term stability.

This confluence of positive signals in key indicators may present Stallion Uranium Corp. as a viable buying opportunity for traders and investors attuned to growth prospects in the uranium sector.

Overall, Stallion Uranium Corp. represents a strategic opportunity in the uranium sector, combining a proven track record, innovative exploration technology, and assets in the world’s richest uranium region. For investors seeking exposure to the clean energy market, Stallion’s approach to tapping into the underexplored potential of the Athabasca Basin, backed by a seasoned team and recent capital infusion, positions it well for future success in a field that is becoming increasingly vital in the global energy mix.

Symbol: (TSX-V: STUD) (OTCQB: STLNF) (FSE: FEO)

Company: Stallion Uranium Corp. (TSX-V: STUD)

Quote: https://finance.yahoo.com/quote/STUD.V

Latest News: https://finance.yahoo.com/quote/STUD.V/news?p=STUD.V

Company Website: https://stallionuranium.com/

Put The Bull Report to the test! Join our exclusive group of traders and if we don’t deliver, simply unsubscribe anytime!

Learn More About (TSX-V: STUD) (OTCQB: STLNF) (FSE: FE0) As News Comes Out at Your Preferred Brokerage Firm

This report is for information purposes only and is neither a solicitation or recommendation to buy nor an offer to sell securities. The Bull Report is not-a-registered-investment-advisor. The Bull Report is not a broker-dealer. Information, opinions, and analysis contained herein are based on sources believed to be reliable, but no representation, expressed or implied, is made as to its accuracy, completeness or correctness. The opinions contained herein reflect our current judgment and are subject to change without notice. The Bull Report accepts no liability for any losses arising from an investor’s reliance on the use of this material. Starting on December 1, 2023, The Bull Report has been compensated $25,000 per month for coverage of STUD by Volans Capital Corp. The Bull Report and its affiliates or officers may purchase, hold, and sell shares of common stock of this stock, in the open market at any time without notice. The Bull Report will not update its purchases and sales of this stock in any future postings on The Bull Report’s websites. Certain information included herein is forward-looking within the context of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements concerning manufacturing, marketing, growth, and expansion. The words “may”, “would,” “will,” “expect,” “estimate,” “anticipate,” “believe,” “intend,” ” project,” and similar expressions and variations thereof are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could affect actual results and cause them to differ materially from expectations expressed herein. *The Bull Report does not set price targets on securities. Never invest in a stock discussed on this website or in this email alert unless you can afford to lose your entire investment.

Sources:

https://stallionuranium.com/_resources/presentations/corporate-presentation.pdf?v=0.320

https://finance.yahoo.com/news/stallion-discoveries-closes-over-subscribed-162500025.html

https://finance.yahoo.com/news/stallion-uranium-provides-exploration-horse-134000929.html

https://finance.yahoo.com/news/stallion-discoveries-launches-survey-over-122500315.html

https://www.barchart.com/stocks/quotes/STUD.VN/opinion

https://query.prod.cms.rt.microsoft.com/cms/api/am/binary/RW1fApfh

https://www.theverge.com/2023/9/26/23889956/microsoft-next-generation-nuclear-energy-smr-job-hiring

Investors, Stay Informed: Private Prison Stocks News Update

Unveiling Success: Assessing Private Prison Stocks Performance

Ready to Invest? Our Breakdown of Private Prison Stocks Analysis

Lets Ride the Wave: Optimistic HTZ Stock Forecast Insights

Unveiling Opportunities: Our Take on NASDAQ:HTZ Stock Analysis

The Capital Report

1910 Pacific Ave,

Suite 2000, Dallas, TX 75201

marketing@stud.report / 1.469.592.7938